Reserve Bank Repo Rate. That's in line with the global trend by central banks to try to offset the impact of the coronavirus on businesses and consumers. The word 'Repo' technically stands for 'Repurchasing Option' or 'Repurchase Agreement'.

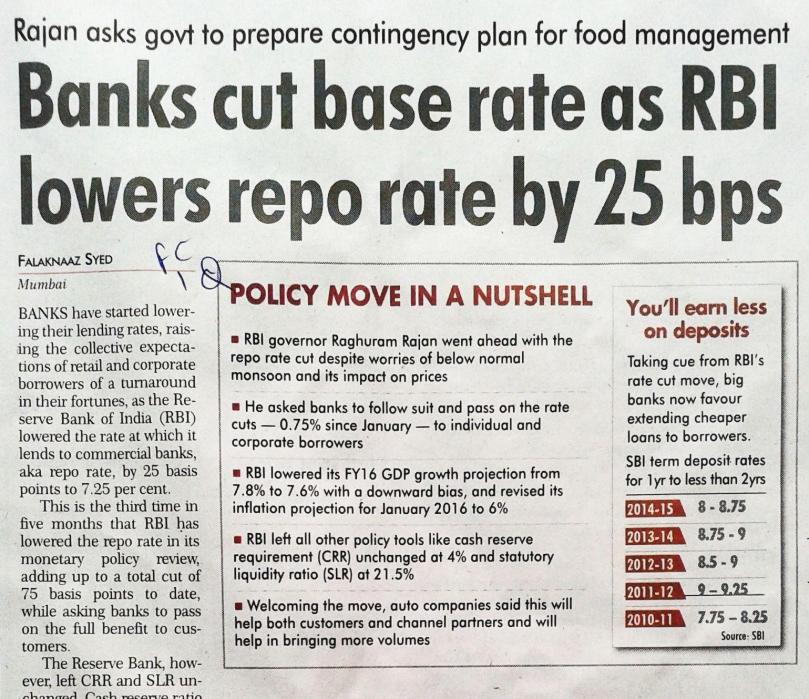

Repo rate refers to the rate at which commercial banks borrow money by selling their securities to the Central bank of our country i.e Reserve Bank of India (RBI) to maintain liquidity, in case of shortage of funds or due to some statutory measures.

Revised time series for the nominal and Real effective exchange rates of the rand.

The certification names are the trademarks of their respective owners. Banks use them to make money. This article outlines the functioning of repo markets, as Reserve Bank liquidity management operations are aimed at maintaining the overnight rate close to the OCR by avoiding large swings in the volume.